Apartment Index

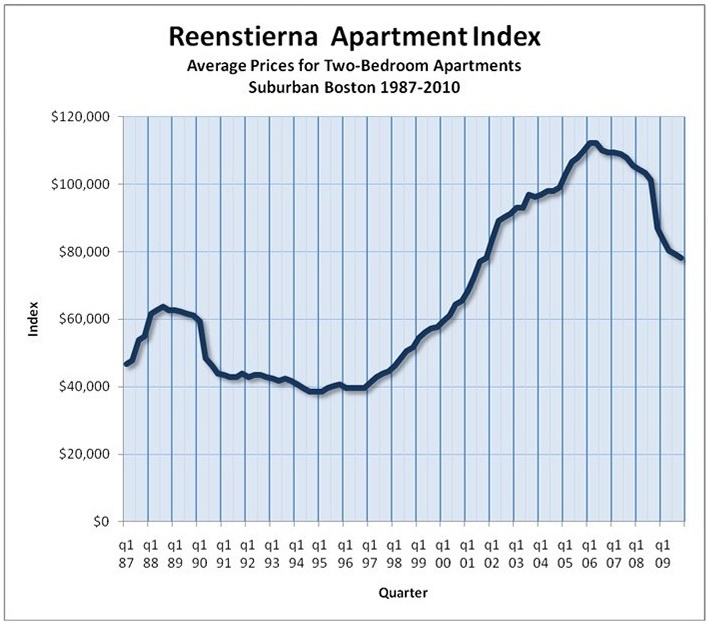

This issue of the Reenstierna Associates’ Report introduces the

Reenstierna Apartment Index. The index uses sale and resale data

to track the average price of apartments in the Greater Boston suburban

ring from 1987 to 2010. It is shown as a chart. The

February, 2010 version of the chart is displayed here. Later

versions may be found by way of the “Index” tab on the top

bar of the Reenstierna Associates’ home page or by clicking on

this link.

A few words about what the chart shows are useful.

The most striking features are the two price peaks that were reached in

1988 and in 2006. Each of these was preceded by a strong run-up

– in the case of the 2006 peak, over a period of seven to eight

years. Each was followed by a sharp, one-year decline. The

chart confirms what we knew in a general way for fact. But it

provides better detail. The 1989 decline reduced prices by about

35% from the 1988 peak. The 2008-2009 decline by early 2010 has

reduced prices by 30%. If history is a guide to the future, we

would say that, in 2010, a leveling of prices appears likely for a

period of ten years, to be followed by a price run-up of seven years, a

two-year peak, and another sharp decline.

The

Reenstierna Apartment Index, like indexes for the stock market or for

the price of gold, allows us to track the success or failure of

investments in this market made at various entrance and exit

points. Setting aside the net income earned by an apartment

building from annual cash flows (a feature not available from

investments in gold) and measuring strictly on the basis of price

changes, we can say that all-cash, unleveraged investments in suburban

Boston apartments on average produced these results:

• a doubling of price for a building bought in 1999 and sold in 2005

• a tripling of price for a building bought in 1994 and sold in 2005

• a loss of 30% of price for a building bought in 2006 and sold in 2009

Leverage through collateralized loans, more available for real estate

than for most other competitive forms of investment, magnifies these

results. An investment made at a 75% loan-to-value ratio in 1999

and sold in 2005 produced not a two-fold but a five-fold increase in

equity (30%, compounded, per year). The same investment made in

1994 and sold in 2005 produced a nine-fold increase in equity (22%,

compounded, per year). Conversely, for the 75% loan-to-value

investment made in 2006 and sold in 2009, the effect of leverage is

catastrophic, wiping out 100% of the equity, and more. The old

adage about real estate was “location, location,

location.” A better adage for recent decades might be

“timing, timing, timing.”

A few words are also useful about how the chart was created.

The source of the data is sales and resales of individual buildings of

four or more living units in the Greater Boston suburbs.

Buildings of three or fewer units are excluded, because these are often

partially owner-occupied. Owner-occupants have different

motivations from those of rental income investors, and inclusion of

small buildings could alter the graph. Buildings in urban

locations (the Back Bay, Chelsea, Somerville, or Lawrence) are

excluded. Some of these experienced an exaggerated price

“bubble” and a subsequent price decline of not 30% but 50%

in 2008. Others were affected by rent control and experienced a

price surge when rent control was abolished in the mid-1990s; inclusion

of these would produce abnormal readings. Buildings that

experienced foreclosure during the sale-and-resale period are

excluded. Foreclosure can be more than an economic event.

It may be accompanied by abandonment of the building, freezing, and

removal of pipes, systems, and kitchens, making the building very

different at any post-foreclosure sale from what it was before.

The process of data exclusion creates a chart that tells us something

about apartment prices in largely middle-income suburbs. An

equally valid chart could be created for lower-income cities. A

different chart could be created for the market of

three-families. A word of caution is in order. The suburban

apartment chart may be an inaccurate source of price change information

if applied to urban apartments or to three-families.

The process of data exclusion also results in a diminished number of

data points from which to derive the quarterly averages. Some

years (1996-1999 or 2005-2007) show a high volume of sales and a

relatively consistent picture, with small variation around the

average. Others (1990-1992) show few data points. Still

others (2001-2003) show a high volume of data points but greater

variation. The data line presents the best match between the data

points at any point in time. It is, however, somewhat

over-simplified. The line might be thought of as the center line

of a river. The center line of a river doesn’t entirely

describe the river. A river can also be described by its

banks. The “banks” of the river of data from which

this line graph are derived at some points broaden to 10% or more on

either side of the line.

This office will produce regular updates of this graph, on a quarterly basis, as the market continues to produce new data.

About Us

Eric Reenstierna Associates LLC is a real estate appraisal firm taking on valuation and consultation assignments in Greater Boston, Massachusetts and New England. Eric Reenstierna, MAI, is the office's principal and is a commercial real estate appraiser.

Explore

Contact

24 Thorndike Street

Cambridge, Massachusetts 02141

(617) 577-0096

ericreen@tiac.net