Residential, The Bottom Line

This study delves into a matter that could be considered in a political light:

which stratum of homeowners has profited the most from home ownership in the past

28 years? The purpose of this study is not to be political. It is simply to

set forth facts.

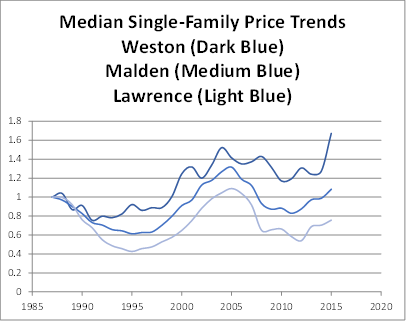

As measured by trends in single-family prices, inflation has caused all segments

of the Greater Boston market to increase in value. The rates of increase from

1987 to 2015 are as follows:

Weston (the high end): up 277% from 1987 to 2015

Malden (the middle): up 144% from 1987 to 2015

Lawrence (the low end): up 70% from 1987 to 2015

Expressed as a compound rate of return, the overall results from 1987 to 2015 are as follows:

Weston: up 4.85% per year, compounded

Malden: up 3.24% per year, compounded

Lawrence: up 1.93% per year, compounded

Inflation explains much of the change. Stripped of inflation, the results are as follows:

Weston: up 67% from 1987 to 2015

Malden: up 8% from 1987 to 2015

Lawrence: down 24% from 1987 to 2015

The bottom line is this. Without inflation, a dollar invested in a Weston house

in 1987 grew in value to $1.67. A dollar invested in a Lawrence house declined

to $.76.

Without being political, we can say this: as with other measures, such as measures

of income, for the past 28 years, the gap in the value of this asset, the single-family

house, has widened between the high end and the rest.

What does this mean for commercial property valuation? It means that appraisers

should be aware of the demographics of the communities where they make appraisals.

We make appraisals of buildings. But what is happening to the people in the

buildings is important to building valuation as well.

What is well known is that gains in income over the past 30 years have gone more

to high-income people than to low-income people. How that translates into an

effect on property values isn't known until we make a study like the one

presented here. As we might have expected, house prices for people at the high

end have gone up much more than have house prices for people at the low end.

It is not enough for an appraiser to know that incomes and prices for real estate

have gone up at a particular rate for an entire metropolitan area. It is important

to know the demographic trends community by community. The income trend for a

community is likely to translate into a price trend for various types of real

estate in that community - houses, apartments, and even retail.

About Us

Eric Reenstierna Associates LLC is a real estate appraisal firm taking on valuation and consultation assignments in Greater Boston, Massachusetts and New England. Eric Reenstierna, MAI, is the office's principal and is a commercial real estate appraiser.

Explore

Contact

24 Thorndike Street

Cambridge, Massachusetts 02141

(617) 577-0096

ericreen@tiac.net