Calamities

Analysts have every reason to expect that the coronavirus will result in a drop

in prices for apartment buildings. Out-of-work tenants are less likely to be

able to make rent payments. Rent moratoriums prevent landlords from taking

action against non-paying tenants. Rent losses increase. Buildings' net

incomes decline. Value depends on income, so prices decline.

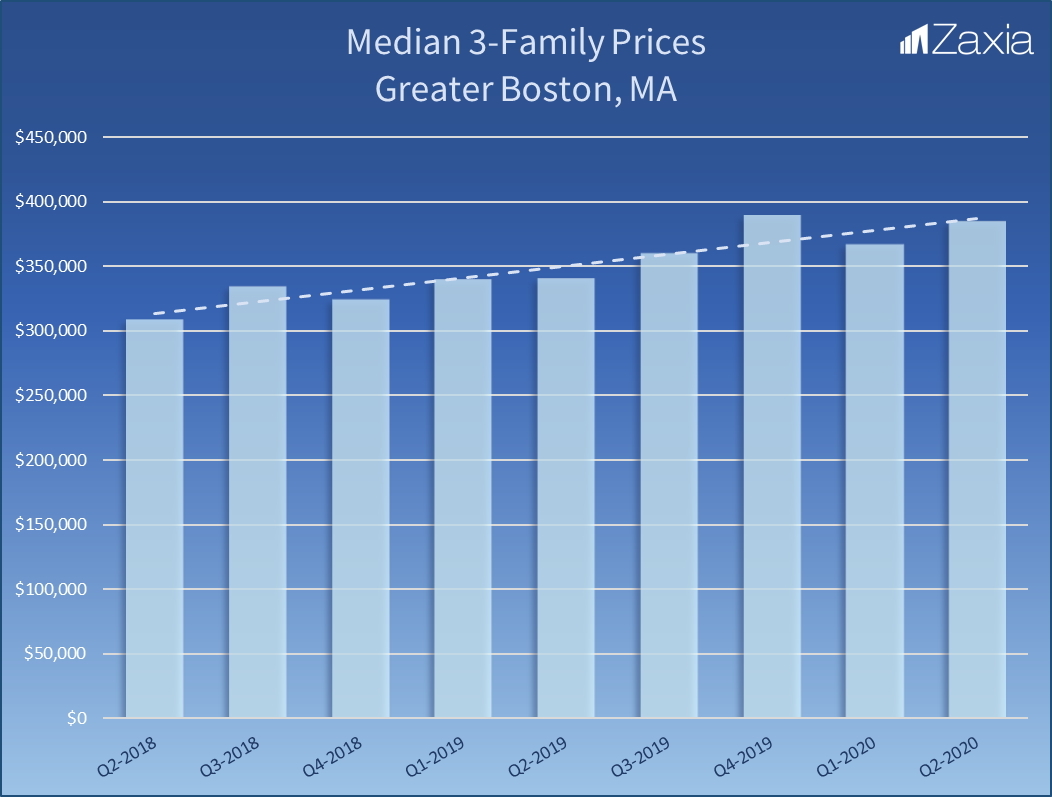

But the data don't always tell the story we expect. Zaxia, a commercial real

estate Web site, publishes a median price trend chart for the most common small

apartment type in Greater Boston, the three-family. Zaxia's second quarter data

include property transfers that took place in the months of April, May, and

June of this year. The second quarter median price shows no decline from the

first quarter. It shows a continuation of the steady trend to price increases

in the three-family market dating back two years.

Zaxia also publishes a median price trend chart for each of nine of Boston's

satellite cities plus Dorchester, quarter by quarter, for the last two years.

Zaxia aggregates the data from these ten communities to produce the Greater

Boston trend chart.

Three-families are a good barometer for the larger small apartment market and,

to an extent, for larger apartments. Single-family houses are owner-occupant

properties, and their price trend says little about investment properties. The

same is true of two-families, which in most cases are owner-occupied.

Three-families, on the other hand, are largely rental income properties. They

are a favorite of small investors. What is true of rents and prices for

three-families is generally true for four-families and up. Most three-families

date from 1900 to 1920. They include the familiar "three-decker." The volume

of sales of three-families, running to 250 in a typical quarter, makes their

price trends statistically significant.

Generally, Boston's satellite cities have seen upward price trends in 2018-2020.

Brockton showed 20% appreciation in the last year, Lowell 25%, and Fall River 30%.

Fitchburg, on the other hand, has shown a 20% decline. Other cities are intermediate

and typically show an upward trend. Dorchester, with the highest prices of any

of the communities, has seen level prices in recent years.

Prices have risen, but the volume of sales has declined sharply. See Zaxia's

chart of quarterly sales volume over the past two years. A decline in volume,

if sustained, means that buyers no longer agree with sellers' expectations for

price and may foretell a later market decline. Or, it may be that both buyers

and sellers have gone to the sidelines, to see where prices shake out.

Overall appreciation for three-families in Greater Boston has been 25% in two years.

About Us

Eric Reenstierna Associates LLC is a real estate appraisal firm taking on valuation and consultation assignments in Greater Boston, Massachusetts and New England. Eric Reenstierna, MAI, is the office's principal and is a commercial real estate appraiser.

Explore

Contact

24 Thorndike Street

Cambridge, Massachusetts 02141

(617) 577-0096

ericreen@tiac.net